How to protect your assets

Where to put all that money? An admittedly somewhat gloating question that will certainly only concern a portion of our readership, but could be all the more valuable for them.

Cash is dead, long live cash. Not only since the current inflation (2022) of more than 7%, we are noticing a noticeable increase in inquiries from our clients regarding future and crisis-proof investments. The desire to invest one’s own assets in certain stable forms of investment and still be liquid quickly is understandable and makes sense, especially in turbulent times like these.

Anyone who has already invested part of their assets in classic investment formats, such as securities, real estate or company shareholdings , should in any case consider investing a further part of their savings in alternative forms of investment in a crisis-proof manner . There are many good reasons for this: geopolitical aspects, natural phenomena, government arbitrariness as well as tax-related aspects should be considered as decisive criteria.

Potentially lucrative alternative investments

The list of alternative investments is long and, in theory, anything that can be resold could qualify as such. Decisive for a long-term investment option, however, are aspects such as: rarity, demand, stable value, and performance. A certain enthusiasm for the corresponding form of investment can often be conducive to an optimal value assessment. Accordingly, typical alternative value investments are:

- Art, art objects and objects: Supposedly an expensive hobby of the rich and beautiful, art has always been a sought-after asset among the common people as well. The advantages are obvious, as it is usually easy to move and can be sold quickly if capital is needed. In the case of rare pieces, an enormous increase in value can even be expected.

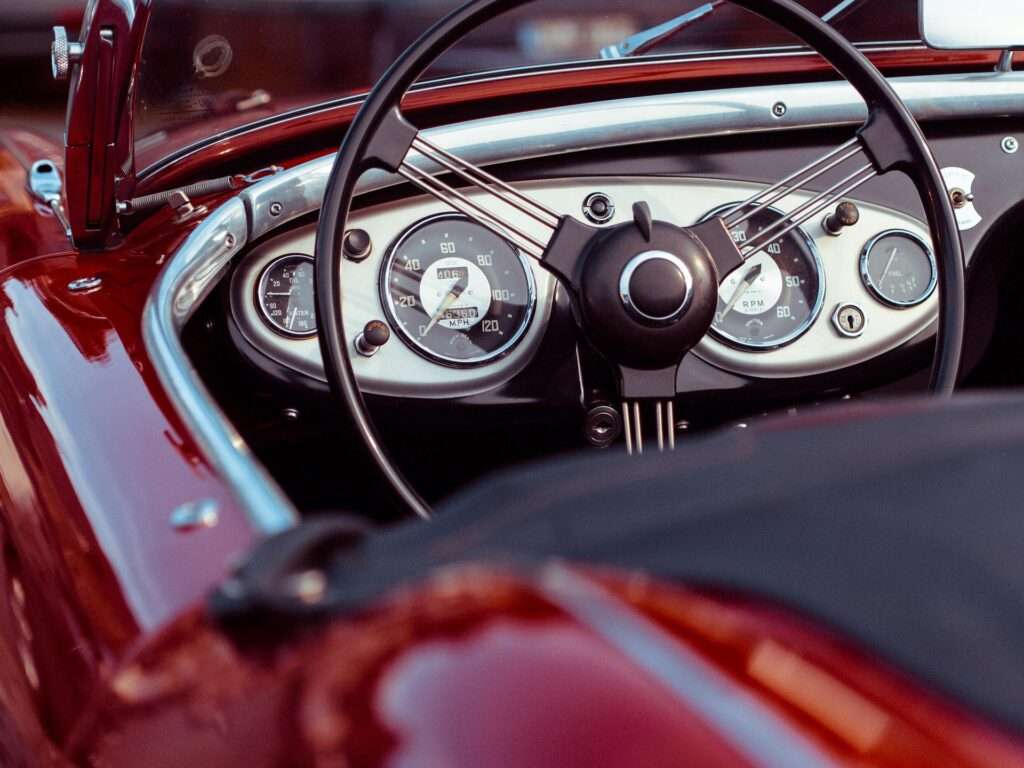

- Oldtimer & Youngtimer: The German best piece, the car. Rare and sought-after automobiles with the appropriate years under their belt are considered sought-after collector’s items and great investments. Motorcycles and other machines with historical or contemporary value can also be a sensible capital investment. Driving fun guaranteed!

- Furniture: If the following names mean something to you and you like design, furniture would be a lucrative form of investment, especially when it comes to originals – Mies van der Rohe, Marcel Breuer or Eams should then not be unknown to you.

- Wine: the investment form with temptation. There are many great wines that not only get better with the years, but also more valuable. Names like Château Lafite or Château Pétrus are well-known wines that achieve top prices in the six-figure range at auctions. Provided good storage, a great form of investment, which is not entirely cheap and very fragile.

- Stamps: The supposed dullard among investment opportunities. Enormous expertise is required here, because the blue Mauritius is known not to exist in unlimited quantities and a potential return is difficult to calculate.

- Watches: Have long been a sought-after collector’s item. Especially German and Swiss watches are very popular among collectors and watch fans. Value, as is so often the case, depends on brand, quality and technical sophistication. Investing in watches is a stable value alternative that looks beautiful on your wrist.

- Diamonds: Only the material value and quality are decisive here. Only special diamonds can expect to increase in value. Storage and protection can run into money very quickly.

- Precious metals: The supposedly safe investment with the currency risk. There are many ways to invest in precious metals, especially gold. Whether bars funds or certificates, all variants have one thing in common: they are subject to price fluctuations and are traded in dollars. You don’t usually make big leaps here. Furthermore, it is assumed that the real quantity differs greatly from the securitized quantity of precious metals.

- Coins: A classic that enjoyed great popularity even in grandmother’s time. A distinction is made here between two types of investment:

1. collector coins: appear in limited form and usually have only a low material value. Here, the value is largely dependent on demand and rarity and is subject to strong trends. The investment risk is relatively high.

2. bullion coins: are classically coins that draw most of their value from the material value of the coin. The most prominent example here is probably the Krugerrand, which is made of pure gold, silver or platinum. Accordingly, the price is very much dependent on the current prices of precious metals.

Among the obvious advantages of this investment, of course, is the fact that the asset is acquired physically and is mobile. At the same time, this must also be protected from unauthorized access, which can involve considerable additional costs.

How we support you with alternative investments:

- Tax law advice and tax representation in Germany

- Independent advice on capital investments in the context of tax optimisation

- Advice on asset allocation and tax optimization

- Conception and planning of investment strategies in close cooperation with our network

- Accounting and asset management

- Communication with the local authorities

- Advice on the subject of inheritance in Germany